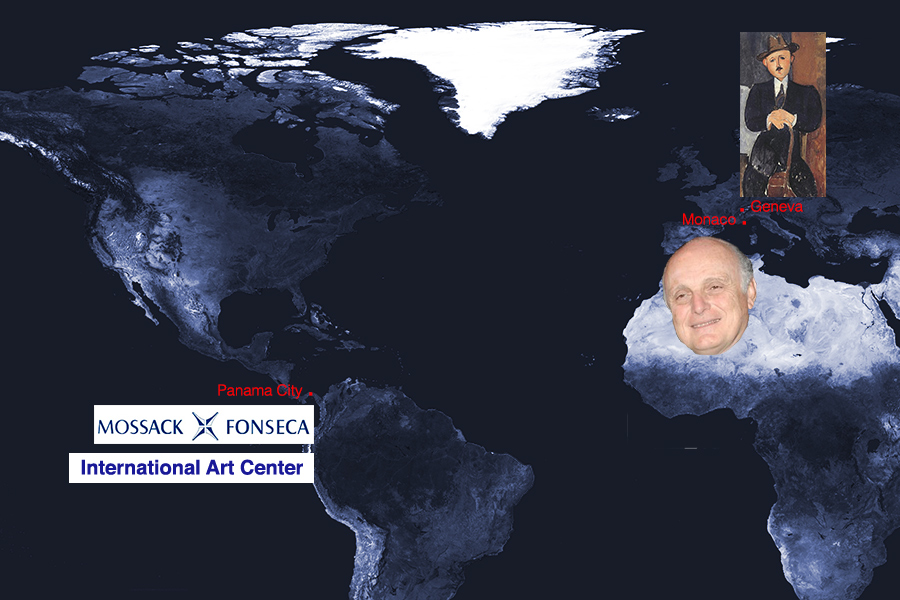

A

map featuring the names of companies set up by Mossack Fonseca, the

faces of the collectors and financiers on whose behalf they were set up,

and Amedeo Modigliani’s “Seated Man with a Cane” (1918), recently

seized following the Panama Papers leaks. (all images by Benjamin

Sutton/Hyperallergic)

Armed with the Panama Papers, Süddeutsche Zeitung, the Washington, DC-based International Consortium of Investigative Journalists (ICIJ), and a consortium of other news organizations have published reports and articles offering a glimpse into a world of financial sleight of hand that many know exist, but to which few ever gain access. Unsurprisingly, much of the wealth at play in this shadow economy is bound up in art.

In the reports on the Panama Papers to date, art figures primarily as another asset class, ownership of which Mossack Fonseca frequently helped its clients conceal in order to avoid paying taxes, to keep it from soon-to-be-ex spouses, or to evade restitution claims. But the leaked documents have also revealed the offshore business dealings of prominent figures in the art world, including Artinfo.com publisher Louise Blouin, the founder of the China Guardian auction house Chen Dongsheng, the artist and arts patron daughters of Azerbaijan’s billionaire dictator Ilham Aliyev, Spanish baroness and art collector Carmen Thyssen-Bornemisza, and even Pablo Picasso’s granddaughter, Marina Ruiz-Picasso.

While countless more stories about how art plays into the portfolios of the world’s wealthiest are sure to emerge in the coming days and weeks, three particularly high-profile cases have already helped draw the outline of the global system of concealment administered by Mossack Fonseca.

No-digliani: David Nahmad and International Art Center

David

Nahmad and his relatives used the Panama-registered company company

International Art Center — set up by Mossack Fonseca — to conceal their

ownership of Amedeo Modigliani’s “Seated Man with a Cane” (1918), which

was recently seized in a raid on Geneva Freeport.

The work, worth $25 million, has been at the center of an argument between Philippe Maestracci — who claims that his grandfather, the Jewish art dealer Oscar Steittiner, had originally owned it before Nazis seized it — and the Nahmads — a family of billionaire art dealers and collectors, who exhibited the painting in 1998 at their Helly Nahmad Gallery in London and in 1999 at the Musée d’Art Moderne de la Ville de Paris. It was also featured in 2005 at the gallery’s New York space in a Modigliani exhibition.

As ICIJ’s Jake Bernstein reported, the family has denied possession of the work, arguing that it belonged to a Panama-based company called International Art Center, which had purchased the work at auction in 1996 — two years before its public display at Nahmad Gallery — for $3.2 million. Its provenance was discovered by Mondex Corp., a Toronto-based firm that helps recover stolen or looted art. Mossack Fonseca’s records, however, indicate that Giuseppe Nahmad, the family’s patriarch who passed away in 2012, had himself registered International Art Center with the Panamanian law firm in 1995. Another document showing minutes from a January 2014 meeting of International Art Center’s board of directors reveals that Monaco-based billionaire David Nahmad — one of two surviving brothers — that day became the sole owner of the company. Since its ownership was initially held in bearer shares, according to Bernstein, it had been impossible to figure out who controlled the company.

ICIJ brought the records confirming the Nahmads’ ownership of International Art Center to David Nahmad’s lawyer, Richard Golub, who simply responded, “whoever owns IAC is irrelevant. The main thing is what are the issues in the case, and can the plaintiff prove them?”

Nahmad himself denied the allegations, telling Radio Canada last week, “I would not be able to sleep at night if I knew I owned a stolen object. That brings bad luck. It’s an enormous crime. There is one thing that I believe wholeheartedly: don’t profit off the suffering of the victims of war.”

International Art Center is actually one of two companies the Nahmads have registered with Mossack Fonseca, although it may have previously existed in another form: one of the Mossack Fonseca documents indicates that International Art Center acquired the Edgar Degas pastel “Danseuses” in October 1989. The second, company, known as Swingon International Ltd., was established in 1992 in the British Virgin Islands. According to other leaked records, the Nahmads were among the first to offshore art using Mossack Fonseca’s services.

Ganz Too Soon: Joe Lewis, Christie’s, and Simsbury International

Using

Simsbury International Corp., a company set up by Mossack Fonseca on

the small South Pacific island of Niue, London-based financier Joe Lewis

acquired the Ganz collection and consigned it to Christie’s in New

York.

On November 10, 1997, Christie’s held a single-owner sale of 58 works from the collection of Victor and Sally Ganz at its New York auction house. The costume jewelry magnate and his wife had spent $2 million amassing one of the world’s foremost collections of modern and contemporary art. Their holdings included the largest Pablo Picasso collection in the US, as well as many works by Eva Hesse, Jasper Johns, Robert Rauschenberg, and Frank Stella.

The Ganz auction brought in a whopping $206.5 million, making it, at the time, the biggest single-owner sale of all time (by more than $80 million). That night Picasso’s “Women of Algiers (Version O)” (1955) — which last year became the world’s most expensive painting sold at auction when it fetched $179.4 million, again at Christie’s — sold for $31.9 million. The night’s top lot, Picasso’s portrait of a sleeping Marie-Therese Walter “The Dream” (1932) — which Ganz bought for $7,000 in 1941 — went for $48.4 million. Who, other than Christie’s, reaped the benefits from the blockbuster Ganz sale?

Not the Ganz children, who, the Panama Papers revealed, sold their parents’ collection six months before the Christie’s auction to pay off inheritance taxes. Over 100 works from the Ganz collection were bought for $168 million by Simsbury International Corp., a company based on the small Pacific Island of Niue (population 1,190) and whose registered agent was Mossack Fonseca. The person with power of attorney over Simsbury International was none other than currency trading billionaire Joe Lewis, who at the time was not only the richest man in England, but also Christie’s biggest shareholder.

The Panama Papers suggest that the sale of the Ganz collection to Simsbury International was brokered by Spink & Son, an auction house in London that Christie’s had acquired several years prior. Under the terms of several agreements dated May 2, 1997, Simsbury International committed to consigning the works it had bought to Christie’s. A clause in one of the contracts specified that if the final bid prices for all the works sold at the Ganz auction exceeded the $168 million paid by Lewis’s company, Spink & Son and Simsbury International would split the difference. Though the sale’s final tally of $206.5 million includes the auction house’s commissions, it clearly surpassed the contract’s $168 million threshold, netting Lewis and Christie’s major returns on their gamble.

Using Mossack Fonseca to set up a company for the sole purpose of buying and consigning the Ganz collection allowed Christie’s to essentially offer the Ganz heirs a $168 million guarantee on the sale of their parents’ collection. The details of the unprecedented arrangement, revealed in full by the Panama Papers, were opaquely hinted at in the catalogue for the Ganz sale, which noted: “Christie’s has a direct financial interest in all property in this sale.” Since Mossack Fonseca helped broker a $168 million guarantee on behalf of Christie’s, auction houses offering sellers guarantees on high-profile lots and collections has become a common practice in the art market.

Sneaky Dmitry: Dmitry Rybolovlev and Xitrans Finance

By

buying art through the British Virgin Islands-based shell company

XItrans Finance Ltd., set up by Mossack Fonseca, Monaco-based Russian

billionaire Dmitry Rybolovlev was able to keep his collection from his

wife when they divorced.

One of these, Xitrans Finance Ltd., held the Rybolovlev collection, valued at $650 million. Established in 2002 — six years before the divorce filings — the offshore company was “no more than a post office box in sunny Tortola,” as Fitzgibbon describes, but “was a mini-Louvre museum when it came to its assets; Xitrans Finance Ltd owned paintings by Picasso, Modigliani, Van Gogh, Monet, Degas, and Rothko. It also bought Louis XVI style desks, tables, and drawers made by some of Paris’s grandest furniture makers.”

Documents from Mossack Fonseca show that Rybolovlev had used Xitrans Finance to transport goods from Switzerland to cities such as Singapore and London. According to Fitzgibbon, both Rybolovlevas declined to comment on the matter. The company is one of two the billionaire owns with ties to Mossack Fonseca.

Rybolovlev’s name has also been in the news for complaints he filed against another one of the Panamanian firm’s clients: Yves Bouvier, a Swiss art dealer known for using and renting out space in many freeports — storage facilities where valuable objects stay untaxed — around the world. Rybolovlev has accused Bouvier of marking up prices of artworks the former had purchased through the latter; the case will be taken up in Singapore, where Bouvier has residency status. Known as the “Freeport King,” he has at least five companies that have connections to Mossack Fonseca, as the firm’s records indicate.

A representative for Bouvier, according to Fitzgibbon, maintains that the Swiss businessman uses his offshore companies “for well-established legal purposes.”

Hyperallergic will continue to report on the latest Panama Papers revelations as they become available.

Δεν υπάρχουν σχόλια:

Δημοσίευση σχολίου